Tax Exemption

Handling sales tax exempt customers in your Avalara AvaTax Connector will depend on how you store your customer exemption certificate information. There are several ways you can manage your customer’s exempt status. Below are the methods available:

1. Automating Certificate Management within Avalara

Avalara AvaTax Exemption Certificate Management System (ECMS) - This is a certificate management tool available to all customers on the Administrator Console. Certificates are imported to the Avalara AvaTax administrator console directly as placeholder records for a real certificate maintained by you on file. Certificates are matched to the CustomerCode (JD Edwards Bill To Address Book Number – AN8) and Ship To State associated to order level line in the GetTaxRequests, and transactions are exempted where appropriate. If ECMS is ACTIVE and in use there is no need to configure the tax certificate exemption number nor UDC 00 / EX special handling codes in JD Edwards unless an override is desired.

2. Manually Maintaining Exemption Certificate Outside of Avalara

JD Edwards EnterpriseOne provides the capability of storing a tax certificate exemption number associated to the address book record which flows to the sales order header tax exempt certificate number field (alias TXCT). The SmarterCommerce AvaTax Connector passes the sales order header tax certificate exemption number to the AvaTax Get Tax Exemption Number (ExemptionNo) parameter (Any string value passed to the ExemptionNo parameter will cause the sale to be exempt. This should only be used if your finance team is manually verifying and tracking exemption certificates.)

Additionally, AvaTax provides an exemption reason the CustomerUsageType (Entity/Use Codes) - Parameter setting allows you to exempt a transaction by passing a pre-coded exemption reason (see values below) or you can create custom reasons with custom rules in the Avalara AvaTax administrator console. This parameter provides a way of explaining the reason for the exemption, but any certificates will still be managed manually by the user.

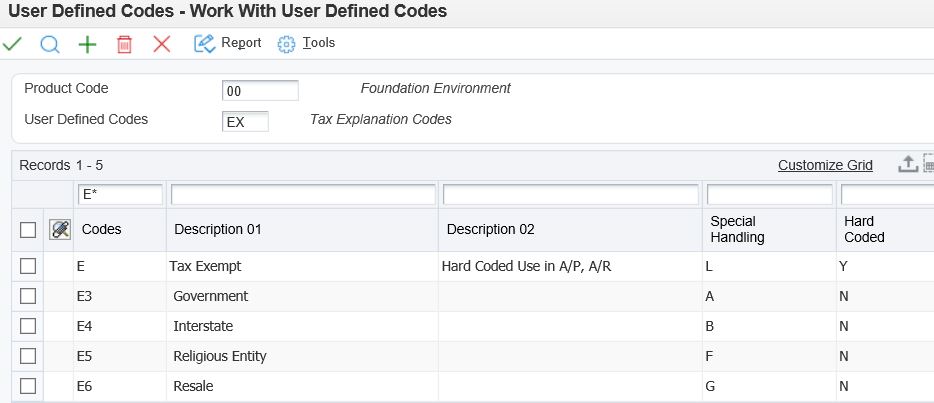

JD Edwards Tax Explanation Codes (User Defined Code (UDC) 00 / EX) are used to determine whether a customer/business is taxable or exempt from tax. Avalara AvaTax uses exemption reason codes called Entity/Use Type Codes (Customer Usage Types). Avalara AvaTax exemption reason codes are as follows:

A) Federal Government

B) State Government

C) Tribal/Status Indian/Indian Band

D) Foreign diplomat

E) Charitable or benevolent organization

F) Religious or education organization

G) Resale

H) Commercial agricultural production

I) Industrial production/Manufacturer

J) Direct Pay Permit

K) Direct Mail

L) Other

N) Local Government

P) Commercial Aquaculture

Q) Commercial Fishery

R) Non-resident

TAXABLE) Not exempt - taxable customer*

Note:

The entity/use code is the letter A-R and TAXABLE. The text after the letter is the exemption reason.

Special limitations:

A, B, and N are for use in the United States only.

P, Q, and R are for use in Canada only.

*TAXABLE used as the Entity/Use Code will make the customer taxable and is how you can make an Exemption Certificate in CertCapture, Certs, or ECMS, explained below, not apply to a sale (force a typically exempt customer to be taxed).

UDC 00 / EX will be used to translate the JD Edwards Tax Explanation Code to the Avalara AvaTax Entity Use Type by using the special handling code field. Map each special handling code in UDC 00 / EX to represent the Avalara AvaTax Entity Use Code to be passed.

Copyright © 2007-2018 Premier Group

3.0.0.0