Supplier Address Overrides

Within Company Settings application (PQ67ATSY) form exit Supplier Addresses configure supplier address overrides to be utilized during sales order entry when a direct ship order line is processed or during purchase order and voucher creation for use tax calculations. The SmarterCommerce Avalara AvaTax Connector will first attempt to retrieve the supplier address for use in tax calculation from Supplier Address Override table (FQ67AT08) if an override address is not found it will retrieve the address from the JD Edwards address book tables. Create supplier address overrides for those suppliers where the JD Edwards address book record does not accurately reflect the ship from address when a sales order direct ship line is created or a purchase order and voucher are created.

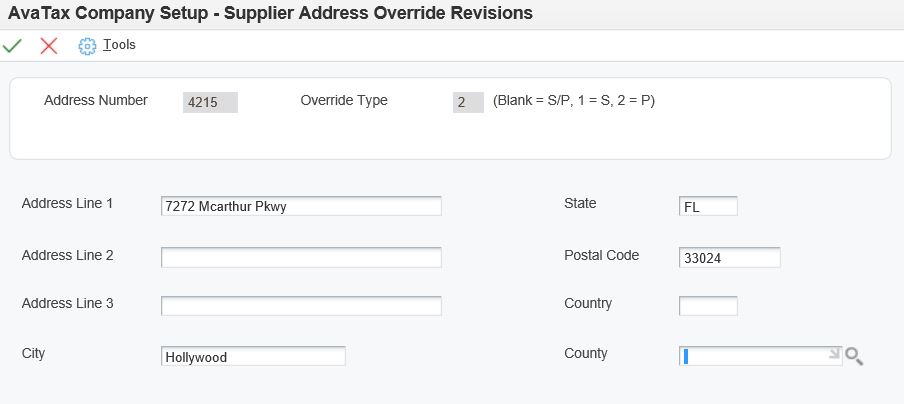

On find and browse form of the Supplier Address Overrides enter the supplier number within the Address Number field in the header of the form. Search for existing supplier number, if not found press Add to add a new supplier address override. Enter the Override Type, where the supplier override address is to be used:

·Override Type equal BLANK = Use override address in both the sales order (S) and purchase order/voucher (P) processes

·Override Type equal 1 = Use override address in sales order (S) processes

·Override Type equal 2 = Use override address in purchase order/voucher (P) processes

If a BLANK override type exist you will not be able to add an override type equal to '1' nor '2' and visa versa if an override type of '1' or '2' exists you will not be able to add a BLANK override type.

Complete the entry of address line 1 through 3 along with city, state, postal code, county and country as needed.

Copyright © 2007-2018 Premier Group

3.0.0.0