Standard Sales Order

For the purpose of illustrating how Avalara AvaTax Tax Calculation when integrated with SmarterCommerce a "standard order" is one where there are no errors or exceptions and the sales order document type is active based on UDC Definitions within UDC 59 / AO - Avalara AvaTax Order Document Types and UDC 59 / AT - Avalara AvaTax Country Validation.

Tax Calculation uses the origin (outbound branch plant address associated to order level line unless line type is determined to be a drop ship line in which case refer to section on Drop Ship Orders) and destination address (ship to address associated to order level line or ship to address override for entire order if one exists) to determine the proper tax rate per order.

To process a Sales Order with Avalara AvaTax Get Tax Calculation complete the following steps. Please refer to the Information Flow diagram for further information. This example will be demonstrated using the P4210 Order Entry application.

Step 1

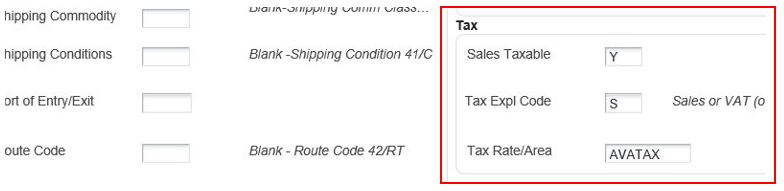

Enter sales order verifying tax related fields, to execute Avalara AvaTax Get Tax calculation, set the Tax Rate/Area field of the order lines equal to the value defined in ATTAXAREAC constant, refer to Constants Settings section of this guide. A tax rate/area set to <blank> or any value other than value found in constant will bypass call to Avalara AvaTax Get Tax calculation. Once all detail lines have been entered as desired press OK. The Order Acceptance screen will be presented.

.jpg)

Step 2

Once the tax rate and amount returned by Avalara AvaTax Tax Calculation are displayed you are ready to place the order (please note that if you are using P42101 to enter orders you can see this information on the Order Summary tab). The sales order will be recorded for further processing.

.jpg)

Step 3

If desired, inquire on the order and use the Online Invoice row exit to review the tax amount calculated.

.jpg)

Step 4

Continue to process the order through to Invoice Print (R42565). Be sure to review the output for this UBE to ensure no errors were reported pertaining to Avalara AvaTax.

Step 5

If desired, login to the Avalara AvaTax Administrator Console account to confirm the tax for the transaction. Please note that the final tax amount is recorded in Avalara AvaTax when the order is invoiced (R42565) in JD Edwards.

.jpg)

Copyright © 2007-2018 Premier Group

3.0.0.0